The increasing demand for financial documentation in both personal and professional settings has led to the rise of tools like the Bank Statement Generator. This software or online tool is designed to create digital replicas of bank statements, which can be used for various purposes. While these generators might seem useful or convenient at first glance, their usage brings up important questions about legality, ethics, and the potential for abuse.

Bank statement generators are often marketed as tools for creating sample documents, especially for educational, training, or demonstration purposes. For example, financial educators might use them to show students how to read a statement, or app developers might test financial applications using realistic-looking data. In these instances, the intent is harmless and the tool serves a practical function. It allows professionals to present financial scenarios without exposing real client data, maintaining privacy and compliance with data protection regulations.

However, the line between legitimate and illegitimate use is thin, and many individuals are drawn to these tools for dishonest reasons. One of the most common misuses is creating fake bank statements to mislead landlords, loan officers, or other entities during verification processes. People might present these fabricated documents to show inflated account balances or consistent income patterns that don’t exist. In doing so, they commit fraud—knowingly providing false financial information for personal gain.

The legal implications of using a bank statement generator for deceptive purposes can be severe. Producing or submitting false documents to obtain money, credit, housing, or other benefits is a criminal offense in most countries. Even if someone claims that they simply “edited” a document or used a template found online, the intent to deceive can result in prosecution. Penalties may include fines, imprisonment, and a permanent criminal record, which can damage future financial and professional opportunities.

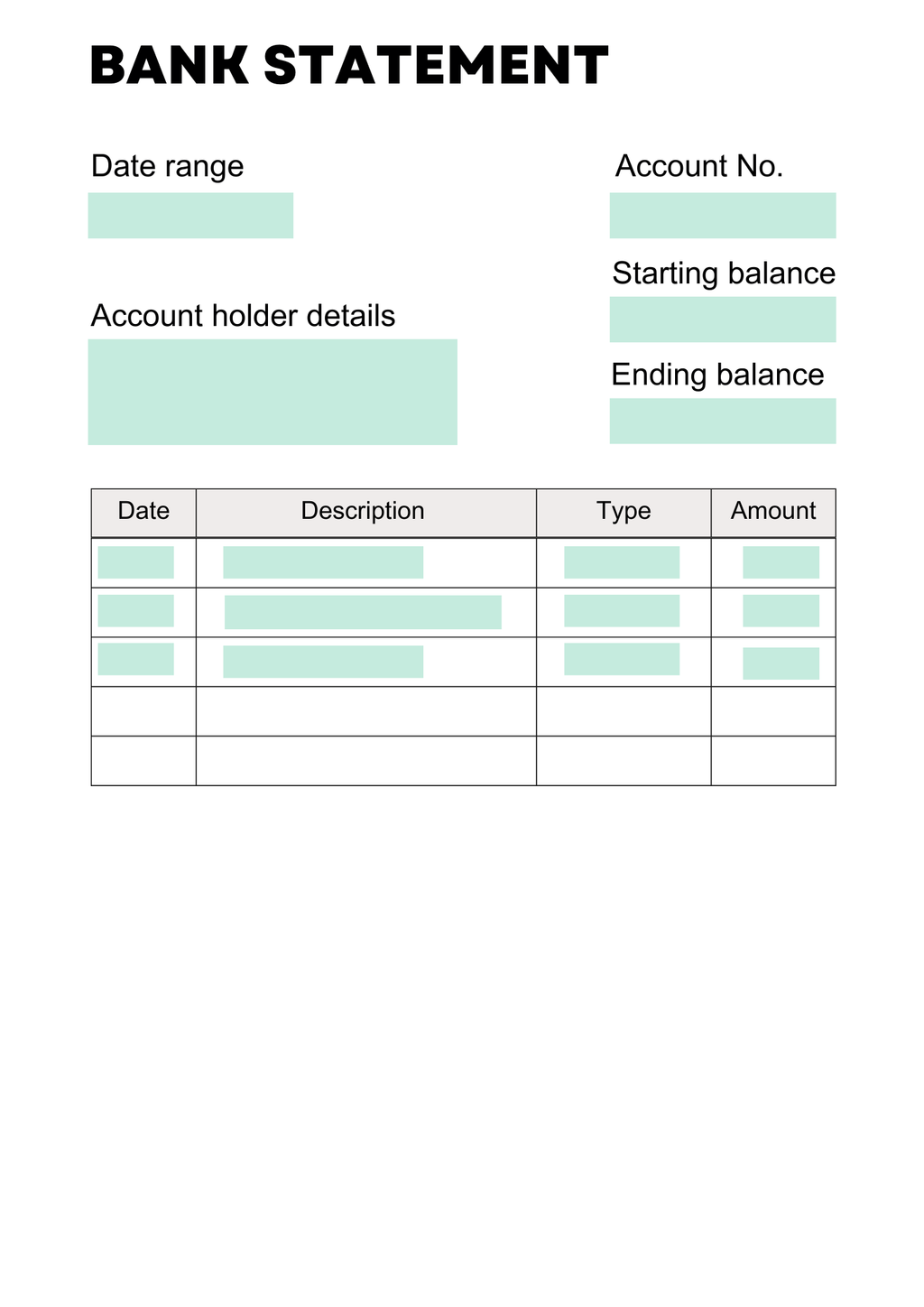

What makes these tools particularly dangerous is how convincing the generated documents can appear. With customizable templates mimicking real bank layouts, fonts, logos, and transaction formats, it can be difficult for an untrained eye to spot a fake. This has led financial institutions to invest in better fraud detection systems and verification protocols. Banks now often cross-check statements with internal data, request additional documentation, or rely on direct verification with employers or institutions to confirm financial information.

In an era where digital tools offer unprecedented access and convenience, users must understand the boundaries of ethical behavior. A bank statement generator is not inherently illegal, but the context of its use defines its legality. When used appropriately—for mock-ups, learning, or system testing—it’s a helpful tool. When used to deceive, it becomes a gateway to serious consequences.

As digital transactions and documentation continue to evolve, maintaining honesty and transparency remains crucial. Individuals and businesses must resist the temptation to use tools like these for manipulation, and instead focus on building trust through accurate and truthful financial representation.